Types of Insurance

When it comes to being prepared for the risks, insurance is considered the most effective method to help protect individuals and enterprises from any sudden or unexpected expenditure or circumstances. Because there are always uncertainties in human life, it is very important to know about insurance and its types. We cannot control the uncertainties in our lives, but insurance can help us or our family to transfer the financial risk associated with the same.

In this article, we are discussing the most common types of insurance. Before discussing insurance types, let us first briefly understand the definition of insurance and its working procedure.

What is Insurance?

Insurance is a contract or a legal agreement between two parties, the insurance company (insurer) and the individual (insured). As per the contract, the insurance company promises to pay out lump-sum amounts for the damages or losses caused to their property. Based on the insurance type and benefits, the insured pays out a premium to the insurance company in return for the contract.

The primary benefit of insurance policies is that they ensure financial security to the insured or his family from future uncertainties. The different types of policies provide support for different types of losses. This can include losses starting from damage or destruction of property to the individual’s death.

How does insurance work?

The insurance plans are shared between an insurer and the insured, where a legal contract or document is signed. All the terms, conditions, and benefits are explained within the documents. It includes all the rules and regulations under which the insurance company will issue the insurance amount to either the corresponding person or the appointed nominees. Because it is a means of protecting the individuals and their families, so the insurance amount can also be given to families or nominees.

In insurance plans, the premium paid for a certain insurance cover is very low; however, the insurance amount which is paid, if eligible, is high. The insurance companies take huge risks and are liable to pay huge amounts of money for small premiums. However, people don’t usually get a claim for high-value amounts. That is the reason insurance companies provide such offers. Any person or company can seek insurance from insurance providers; however, the final decision will only be taken by the insurance company if an applicant is legit and agrees with all the terms and conditions.

Types of Insurance

There are various types of insurance policies, each with different terms and benefits. However, they all focus on protecting certain aspects of our health, property or other assets.

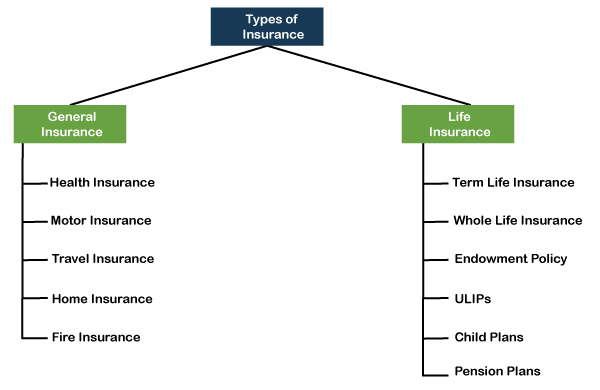

Broadly, the most common insurance policies can be classified into the following two types:

- General Insurance

- Life Insurance

Let us understand both in detail:

What is General Insurance?

General Insurance covers everything except life. This means it provides financial protection for any kind of loss other than death. Under general insurance, insurance companies compensate the insured for financial losses due to liabilities related to bike, car, house, travel, health, etc. Additionally, insurance companies promise to pay or reimburse insurance money to cover losses related to vehicles, medical treatment, theft, fire, or even financial travel problems.

The following are the most common types of General Insurance:

Health Insurance

Health insurance policies provide financial protection against medical care expenses. Insurance companies mainly pay the medical bills of the insured. Some health policies may later reimburse the amount paid by the individual to treat any illness or injury. Depending on the type of health policy, it may provide coverage for various medical care expenses.

A basic health plan typically provides coverage for hospitalization, an acute illness treatment, hospitalization after a medical bill, and daycare procedures. However, most general insurance policies of this type also provide add-on benefits, such as maternity cover, pre-existing illness cover, accident cover, etc. Special plans can also cover pre-hospitalization expenses and resident treatment costs.

Health Insurance usually comes in the following forms:

- Individual Health Insurance: Only one person is insured in this policy.

- Family Floater Insurance: This policy covers the entire family under a single plan; however, it usually includes a husband, wife and only two children.

- Critical Illness Cover: It provides a lump sum for treatment against various fatal diseases, such as heart attack, cancer, kidney failure, etc.

- Senior Citizen Health Insurance: This policy applies only to persons above 60 years of age.

- Group Health Insurance: This type of home insurance policy is provided to companies where the employer insures its employees.

- Maternity Health Insurance: This policy usually covers medical expenses for prenatal and postnatal stages, protecting both mother and newborn.

- Personal Accident Insurance: It is a special type of health insurance covering the financial liabilities arising from accidental injuries, disability, and even death.

Motor Insurance

As the name suggests, a motor insurance policy provides comprehensive protection to vehicles against accidents. It usually offers financial protection against damages, loss due to theft, fire burn, natural disasters, etc. In most countries, including India, motor insurance is mandatory. Motor Insurance usually comes in the following forms:

- Car Insurance: This policy includes four-wheelers purchased by individuals.

- Two-wheeler Insurance: This policy includes personally owned two-wheelers.

- Commercial Vehicle Insurance: It is a type of motor insurance policy that provides financial protection for vehicles owned for commercial purposes.

Travel Insurance

Travel insurance is generally not suitable for everyone. It can be helpful for those who are regular travelers. This type of insurance ensures the financial security of the passengers during the holiday or travel. Depending on the provider and policies, travel insurance may cover additional benefits, such as loss of baggage, loss of passport, flight delays, trip cancellations, and more. Travel insurance usually comes in the following forms:

- Domestic Travel Insurance: Applicable within the country

- International Travel Insurance: Applicable for traveling outside of the country

- Individual Travel Insurance: Applicable when traveling alone

- Student Travel Insurance: Applicable when going outside the country for studies

- Senior Citizen Travel Insurance: Applicable for travelers whose age lies around 60 to 70 years

- Family Travel Insurance: Applicable for family trips or vacations

Home Insurance

Home insurance provides coverage against damage to the home’s contents and structure due to natural disasters and human-made disasters (such as fire, burglary and theft). This insurance policy provides financial security to the person’s home and provides coverage to the house’s valuables.

Home insurance usually comes in the following forms:

- Home Structure/ Building Insurance: It covers a house/building structure against the damage caused by a disaster.

- Public Liability Coverage: This includes a loss to guests or third parties on the insured residential property.

- Standard Fire and Special Perlis Policy: It covers losses due to fire burning, natural disasters (such as earthquakes, landslides, floods, etc.), and antisocial human activities (such as explosions, riots, strikes, etc.).

- Personal Accident: It financially protects individuals and their families in case of any accidental demise due to property damage.

- Burglary and Theft Insurance: It compensates for the loss of goods from the insured property in case of a burglary or theft.

- Contents Insurance: It compensates for the loss of equipment, vehicles and furniture in case of fire, theft, riots, or natural disasters.

- Tenants’ Insurance: It financially covers tenants for losing their personal property and belongings when they live in a rented house.

- Landlords’ Insurance: This includes landlords’ losses against contingencies such as public liability and rent loss.

Fire Insurance

Fire insurance covers damage to goods or property caused by a fire. The insurance company pays or compensates a lump sum equal to the value of the overall loss. This policy covers individuals and companies and helps them re-build corresponding places by issuing insured funds. Depending on the insurance company, this policy may cover the insured property and the surrounding area. This can ultimately help in claiming the expenses of damages against third-party properties. Similarly, it may include war risk, unrest, riot loss, etc.

Fire insurance usually comes in the following forms:

- Valued Policy: The insurer verifies the property and promises to provide a lump sum equal to the property’s value in case of loss or damage.

- Floating Policy: This includes the loss of properties lying at various places.

- Comprehensive Policy: It is also called an all-in-one fire insurance policy. This is because it has extensive coverage for fire, theft, burglary, and several other damages.

- Specific Policy: It includes a specified amount to be paid that is usually less than the property or assets’ actual value.

What is Life Insurance?

A life insurance policy is a type of contract that provides financial protection to the insured (policyholder) against unfortunate events, such as death or disability. This insurance policy ensures financial independence for the entire family after death. Besides, some life insurance plans offer financial compensation after retirement and even after a specific period.

Before availing of life insurance, the policyholder either makes periodic payments (premiums) or pays the insurance company a lump sum to buy the policy. In return, the insurer promises to offer the family a fixed sum in case of uncertainties. This may include events such as disability and death. The policy also provides flexibility to choose the policy term, coverage amount, payment options, and more.

The following are the most common types of Life Insurance:

Term Life Insurance

It is the most popular and widely used type of life insurance policy. Because life insurance policies generally have no maturity value, their premiums are comparatively lower than other life insurance policies. Term insurance provides coverage for a particular period. If anything bad (disability or death) happens to the policyholder, the family will receive a lump sum specified in the insured plan. Further, the insurance company will pay no compensation or amount to the policyholder and his family if the policyholder survives for a specified period.

Whole Life Insurance

Whole life insurance plans offer life-time coverage to the insured. The insurance company will pay a certain sum of money to the insured person’s family after death. They will also be entitled to the bonus that is often earned on such an amount. While the entire life insurance plan offers to pay the death benefit, the plan also includes a savings component, which helps to earn cash value during the policy term.

Endowment Policy

The endowment plan provides financial benefits to the insured against the uncertainties of life. This type of life policy allows the insured to save regularly over a specific period. The policyholder gets a lump sum after the completion of the fixed period. Besides, the insurance company pays the same amount to the policyholder’s family in case of death of the policyholder. Unlike term insurance, the endowment policy pays the full amount even after the policy term.

Money-back Policy

In this policy, the insurer pays a certain percentage of the sum assured at regular intervals to the policyholder as a survival benefit. After the end of the period, the policyholder gets the balance as maturity income. Besides, the policyholder’s family can receive the sum assured in the event of the policyholder’s death during the policy term.

Unit-linked Insurance Plans (ULIPs)

Unit-linked insurance plans provide both investment and insurance benefits under a single policy contract. Some of the premium value goes towards insurance cover, while the rest is invested in debt and equity associated with various markets. However, the policyholder has the facility to choose the allocation of premium across various instruments according to financial needs and market risk appetite. After the policyholder’s death, the policyholder’s family is paid a lump sum.

Child Plans

A child plan is a special type of life insurance policy that helps individuals protect their children’s future financially. The insurance company promises to give a lump sum to the policyholder’s child after the policyholder’s death. Just as the policyholder pays the premium during his life; similarly, the insurer pays the premium to the policyholder’s child at regular intervals after the policyholder’s death.

Pension Plans

A pension plan, or retirement plan, is a type of insurance that allows individuals to accumulate some savings over an extended period. This insurance policy usually helps them create retirement funds, which can be received at regular intervals after retirement in pension. In case of any uncertainty, the policyholder’s family can also claim the sum insured.

Other forms of Insurance

Besides the above-explained insurances, there are several other insurances. Some other popular types of insurances include the followings:

Accident and disability insurance

Accidents are unpredictable and unavoidable. However, they can sometimes be severe and cause disability. It can affect the daily living routine and also leave a huge impact on our earning capacity. This type of insurance can be helpful if we cannot work due to an accident. The insurance can somehow help provide financial stability to our family and us during such difficult times. This insurance is highly recommended for factory workers.

Standalone critical illness insurance

This insurance policy may not be beneficial for everyone. This type of insurance can be helpful for those who have a family history of a certain illness. Most illnesses can be covered under most health insurance policies or linked to life insurance plans. Therefore, a standalone cover for critical illness depends primarily on the family illness’s historical record and an individual’s needs. Sometimes, it can be helpful against epidemics.

Malpractice Insurance

This type of insurance is primarily beneficial for professionals, such as doctors, lawyers, and accountants. Malpractice insurance helps them against claims made by dissatisfied patients or customers. For doctors, the cost of such insurance has been steadily increasing over the years.

Education Insurance

Education insurance can be beneficial for child education. This insurance is a kind of savings tool that can provide the lump sum required for educational needs. However, it applies only to higher education (college studies). The main objective of this education insurance is to help children in further studies without any financial problem. The amount of education expenses is estimated using the Education Planning Calculator. Under this insurance, the money is released in the name of a child, while the parent / legal guardian is the main owner of the policy concerned.

Mobile Insurance

Due to mobile phones’ rising price and their many applications, it has become mandatory to insure mobile devices. Mobile insurance allows us to recover or reclaim the amounts of money spent on repairing the phone in the event of accidental damage. Apart from this, we can also claim the same in case of mobile theft, which will make it easier to get a new mobile.

Bite-Size Insurance

Bite-sized insurance plans can be used for conditions when there are chances of any upcoming threats or damages. This is known as one of the most efficient insurance plans that can protect our finances and minimize our financial liability for certain tenure. Generally, bite-sized insurance provides cover up to a year. The premium for this insurance type is so low that it hardly affects our monthly expenditure. Besides, the sum insured is significant.

Marine Insurance

Marine insurance can be beneficial for those who think they can withstand maritime threats, such as pirate attacks, ship or rock collisions, fires, etc. All such activities can affect individuals financially. Therefore, ships and their loads can be insured with certain conditions. Previously, only some common risks were insured; however, the scope of marine insurance has now expanded into two broad categories – inland marine insurance and ocean marine insurance. While ocean marine insurance only covers maritime hazards, inland marine insurance can cover inland risks from the goods’ loading until the buyer receives the goods.

Social Insurance

Social insurance is mainly beneficial for the weaker sections of the society who cannot pay the premium for adequate insurance. Social insurance helps them take advantage of insurance and stabilize their financial position in case of uncertainty. The most common social insurance types include pension plans, sickness insurance, unemployment benefits, disability benefits and industrial insurance.

Miscellaneous Insurance

Miscellaneous insurance plans can help insure various things, such as property, furniture, machines, goods, automobiles, valuable articles, etc. Any destruction against the insured things due to any uncertain accident or disappearance because of theft can be compensated.

There are many more types of insurance, and they are increasing rapidly over time.

Disclaimer: It is advisable to read the terms and conditions of any insurance before applying for it. The terms, conditions and benefits of the same insurance policy may vary from one insurance provider to another. Therefore, before making any final decision, carefully read a specific insurance type prospectus (written document of all details).

Benefits of Insurance

There are various insurance plans, and their terms and conditions can vary from one country to another. However, there are some common benefits of insurance policies, which are given below:

- Peace of Mind

- Better Risks Control

- Tax benefits

- Pre-planned Savings

- Easy Loan Availability